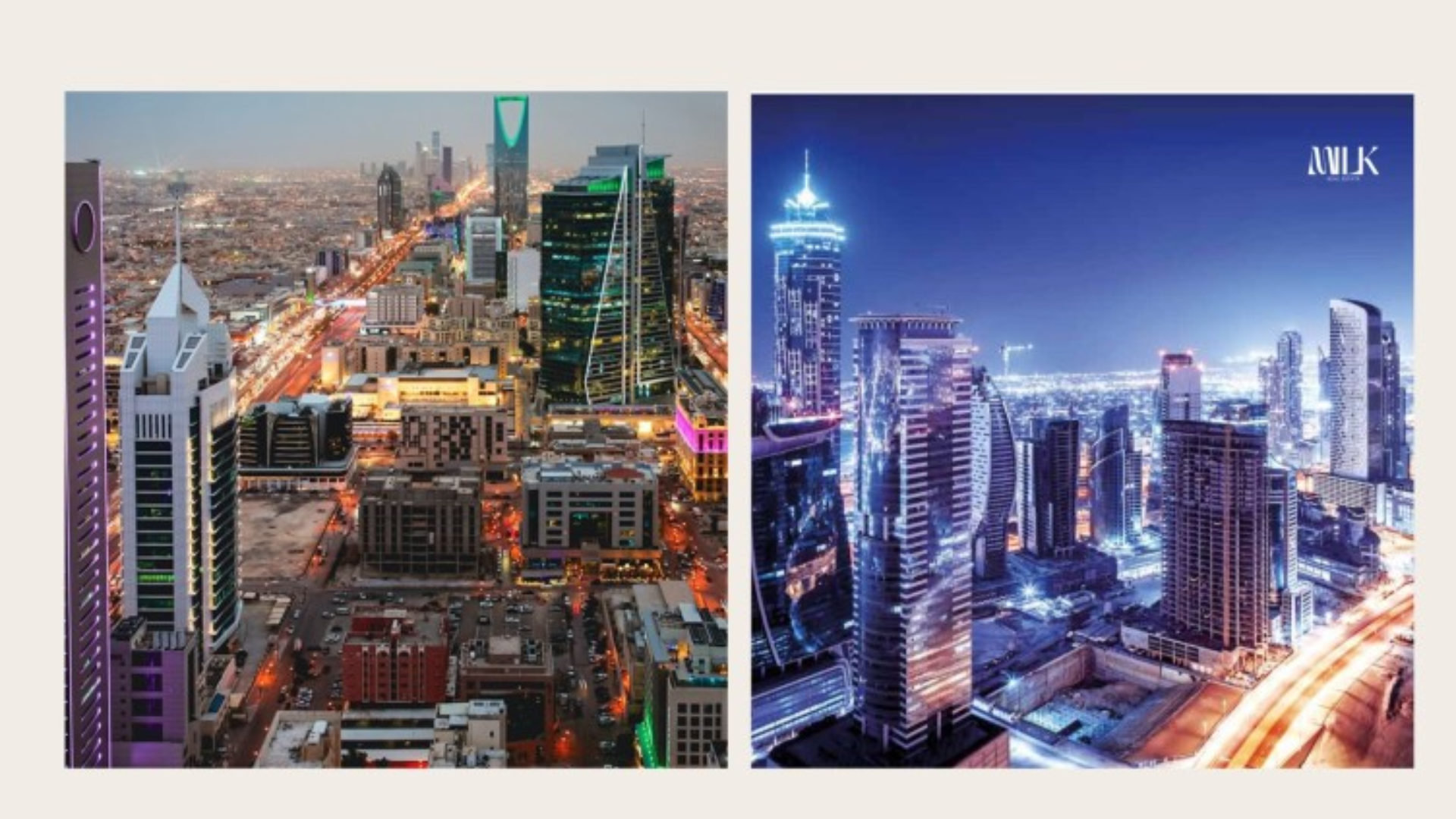

As Gulf cities such as Dubai, Abu Dhabi, and Riyadh continue to evolve into global financial hubs, they are witnessing a sharp increase in centi-millionaire populations. Thanks to investor-friendly migration schemes and transparent business environments, these cities are rapidly becoming magnets for ultra-wealthy individuals seeking stability and growth opportunities.

Dubai’s Millionaire Boom

A recent report highlights that Dubai’s millionaire population has surged by 78% in recent years, placing it among the fastest-growing cities for high-net-worth individuals. This is part of a broader trend across the Gulf region, where cities like Dubai, Abu Dhabi, and Riyadh are predicted to experience an astonishing 150% growth in their centi-millionaire populations by 2040, according to the Centi-Millionaire Report 2024 by Henley & Partners.

The global centi-millionaire club, comprising individuals with assets of $100 million or more, has grown by 54% over the past decade. However, the Gulf region is set to outperform many other parts of the world in the next 15 years, reflecting a significant shift in global wealth distribution.

Gulf Cities on the Rise

While the US and China currently house the largest numbers of centi-millionaires, Gulf cities are catching up at a remarkable pace. The projected growth in Dubai, Abu Dhabi, and Riyadh points to their increasing prominence on the world stage. Cities such as Riyadh are expected to experience a 150% rise in centi-millionaires, similar to other emerging markets like Bengaluru in India.

In the broader Middle Eastern region, Abu Dhabi and Riyadh are set to compete with global heavyweights, attracting entrepreneurs and founders who are crucial to local wealth creation. These individuals not only accumulate significant wealth but also drive economic development by creating numerous well-paying jobs.

Global Trends and Shifting Wealth Dynamics

Globally, centi-millionaire growth has been most pronounced in the US and China. Over the past decade, China has seen its centi-millionaire population grow by 108%, surpassing even the US, which saw an 81% rise. In contrast, Europe has lagged behind, with a more modest increase of just 26%.

While traditional financial centers such as New York, London, and Hong Kong continue to dominate, the rise of Gulf cities signifies a shifting landscape of wealth accumulation. As the elite centi-millionaire class continues to expand, their influence on global economics, politics, and social dynamics is set to grow considerably.

A New Global Wealth Landscape

As the report highlights, the global distribution of centi-millionaires is becoming increasingly diversified. Over one-third of these ultra-wealthy individuals reside in 50 key cities across the globe, with New York, the Bay Area, and Los Angeles leading the way. However, Gulf cities are rapidly rising in the ranks, positioning themselves as future powerhouses for the world’s wealthiest individuals.

In a world marked by economic volatility and political uncertainty, the allure of secure and strategic residence planning has never been stronger. With many countries offering investment migration programmes, including those in the Gulf, centi-millionaires are now more mobile than ever, choosing locations that offer both economic opportunities and stability.

Dubai, Abu Dhabi, and Riyadh are not only set to benefit from this wealth migration but are also poised to become integral players in the new world order of global affluence. Their future looks brighter than ever as they continue to attract the world’s wealthiest individuals, solidifying their status as international financial powerhouses.

Discover how these cities are transforming into the next major financial powerhouses—let’s connect and explore the opportunities! 💬 +971 52 874 2858